In a recent press release, we mentioned utilizing data analytics to help investor and servicer clients better measure risks and rewards of investing in loans with commercial and residential real estate properties as collateral. We are taking that process to the next level of tech-forward thinking by partnering with Relus Technologies.

Working with Relus to utilize the latest version of Apache Spark in an Amazon cloud environment, DIMONT now has the unique capability of predicting potential insurance claim recoveries on nonperforming mortgage loans, and a process to re-calibrate these models as new outcome data is generated from operations These sophisticated models consider multiple attributes over an extended period while adjusting for current market conditions and trends. Building this in a cloud environment insures a secure, highly scalable and cost effective model.

With this capability, DIMONT’s investor clients can now determine the range of potential hazard insurance claim recoveries on a portfolio of properties, thereby unlocking new sources of value in the underlying collateral. The technology that Relus uses complements DIMONT’s proprietary technology platform, Eldorado, and pulls outcome data generated during the hazard claims process for the past few years. This far-reaching information makes it possible to develop future outlooks with a high level of confidence.

Jay Duff, big data practice director at Relus Technologies said, “We are impressed with the richness of DIMONT’s property claim outcome data which generates superior predictive models.”

“Using data that we have generated from our extensive hazard claims recovery work, we have the capability to help our clients evaluate potential investments in mortgage loan portfolios,” said Denis Brosnan, president and chief executive officer of DIMONT.

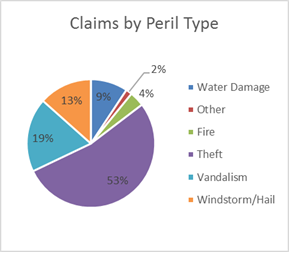

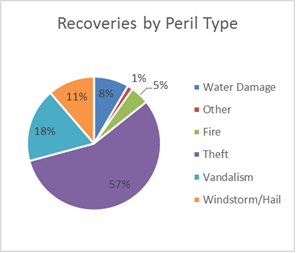

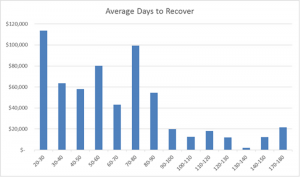

The below graphics illustrate an example of the type of analyses available with this technology.

Sample Data

Peril Analysis

Recovery Time Analysis